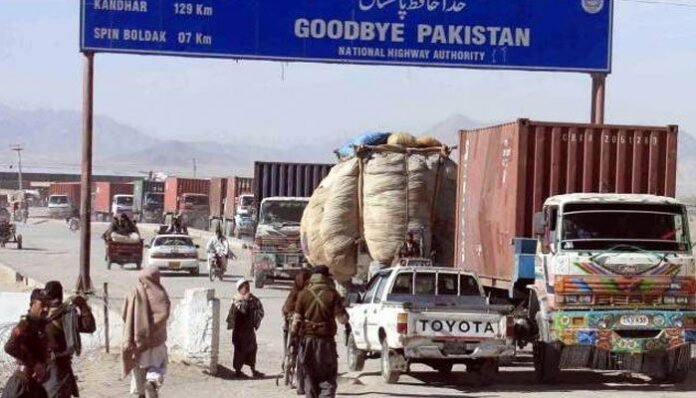

The Auditor General of Pakistan (AGP) has reported an abnormal 69 percent increase in Afghan transit trade cargo during the fiscal year 2022-23, despite no corresponding rise in Afghan demand for these goods.

This surge is linked to Pakistan’s restrictions on the import of non-essential and luxury items, leading to goods intended for Afghanistan being smuggled back into Pakistan due to inadequate tracking and monitoring of transit cargo.

In its latest report, the AGP identified irregularities amounting to Rs. 737.868 billion in the collection and recovery of direct and indirect taxes during 2022-23. The audit, conducted for the year 2023-24, highlighted several areas of concern within the Federal Board of Revenue (FBR).

The report detailed that irregularities in direct taxes amounted to Rs. 616.181 billion. On the indirect taxes front, which includes sales tax and federal excise, irregularities were reported at Rs. 90.334 billion. Customs duty-related discrepancies were found to be Rs. 28.186 billion. Additionally, irregularities in the expenditures of the FBR totaled Rs. 3.167 billion.