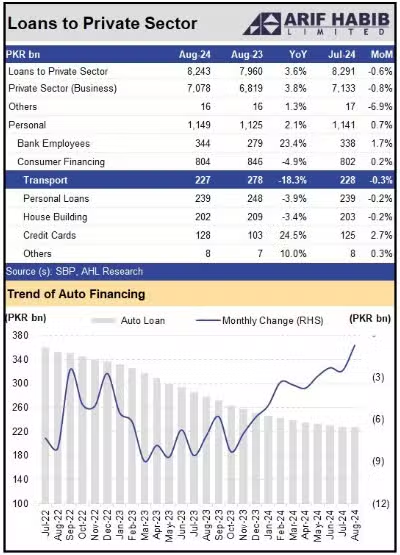

Car financing in Pakistan has experienced a continuous decline for the 26th month in a row, dropping by 18.3 percent year-on-year to Rs. 227 billion by the end of August 2024, down from Rs. 278 billion in the same period last year, according to the State Bank of Pakistan (SBP).

On a month-to-month basis, auto financing decreased by approximately Rs. 700 million compared to July 2024. Despite some improvements in consumer inflation and a reduction in the central bank’s key lending rate, growth in the auto financing sector remains sluggish.

In contrast, personal loans on credit cards have seen a significant increase, rising by 24.5 percent year-on-year to reach Rs. 128 billion by August 2024.

Consumer financing for house building also declined, falling by 3.4 percent to Rs. 202 billion during the review period.

Overall, credit issued to end-users, or consumer financing, decreased to Rs. 804 billion in August 2024, marking a 4.9 percent year-on-year decline.