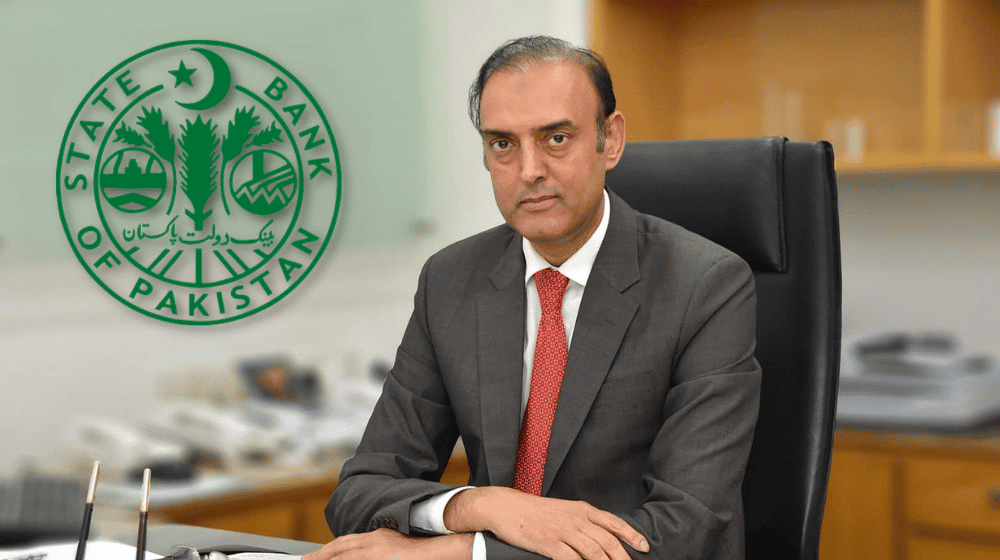

The State Bank of Pakistan (SBP) made a record purchase of $9 billion from the local market in 2024 to maintain foreign exchange reserves amid limited foreign loan inflows, according to Governor Jameel Ahmad. Speaking to journalists after a Senate Finance Committee meeting on Monday, the governor revealed that half of these purchases—$4.5 billion—were made in the second half of the year.

The central bank spent approximately Rs. 2.5 trillion, based on current exchange rates, to acquire the $9 billion. Governor Ahmad explained that these purchases were essential to keep foreign exchange reserves above $11 billion during the first half of the fiscal year. Without this intervention, reserves could have dropped below $3 billion, exacerbating inflation and economic instability.

Defending the move, Governor Ahmad emphasized that the purchases were market-based rather than debt-driven. He noted that this strategy helped prevent external public debt from exceeding $101 billion, even though Pakistan’s total external debt reached $133 billion by the end of 2024. The dollar purchases also created a surplus in the market, which contributed to stabilizing the exchange rate.

“This approach was necessary to avoid a deeper economic crisis and to ensure some level of stability in the foreign exchange market,” the governor stated.

During the Senate Finance Committee meeting, members expressed concern over local payments made to Visa and MasterCard. Pakistani banks reportedly paid $277 million in fees for 287 million transactions conducted locally. The committee chairman criticized these payments and urged the SBP to take steps to halt them.

The committee also demanded a detailed review of the Pakistan Remittance Initiative (PRI), highlighting that 80% of its Rs. 86 billion budget is spent on overseas incentives rather than promoting local remittances. Members called for a more balanced approach to ensure the initiative benefits domestic remittance systems as well.