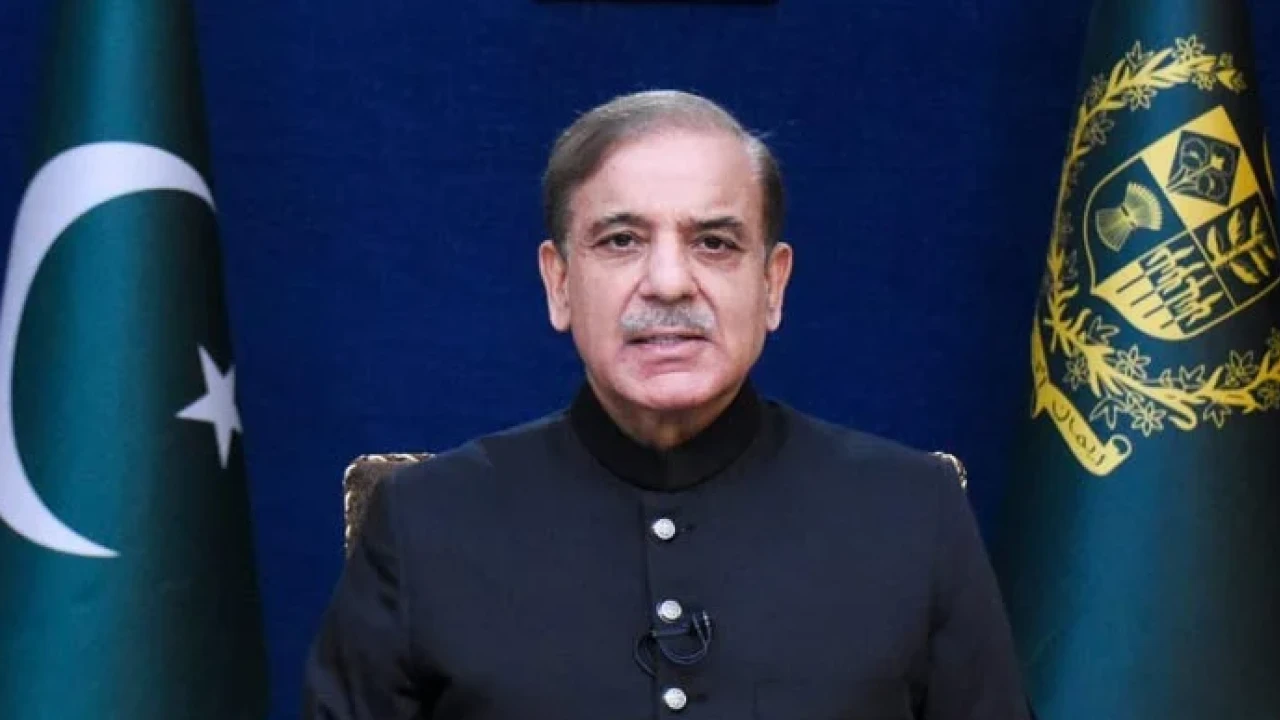

Minister of State for Revenue Ali Pervez Malik announced on Thursday that Prime Minister Shehbaz Sharif has instructed a reduction in the income tax burden on the salaried class. Speaking to the media, Malik highlighted the government’s efforts to address economic challenges and improve fiscal conditions.

He added that the government plans to reduce the tax burden on the salaried class and eliminate the tax on milk, contingent upon the Federal Board of Revenue (FBR) recovering Rs 300 billion to Rs 350 billion from tax evasion related to non-duty paid and smuggled cigarettes.

Malik noted a significant decrease in inflation, which has dropped from over 35% to approximately 7%. He acknowledged the imposition of taxes amounting to Rs. 3,500 billion by the federal government but emphasized the need to curb tax evasion to enhance revenue collection.

The minister acknowledged that the government had made some unpopular decisions but asserted that these measures have set the country on the right path. He also addressed the issue of the current account deficit, which had previously reached $18 billion but has now been brought under control.

To further stabilize the economy, Malik stressed the importance of increasing revenue collection. He expressed the government’s commitment to ensuring that the current International Monetary Fund (IMF) program will be the last, indicating ongoing efforts to strengthen the country’s financial independence.

Additionally, Malik mentioned that the government has approved a summary to bolster the Federal Board of Revenue’s (FBR) enforcement capabilities by increasing its resources, aiming to improve tax compliance and collection efficiency.