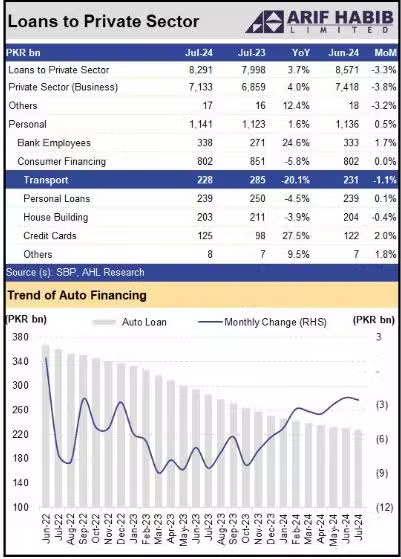

Car financing in Pakistan has continued its downward trajectory for the 25th consecutive month, experiencing a 20.1 percent year-on-year decline.

By the end of July 2024, car financing had fallen to Rs. 228 billion, down from Rs. 285 billion in the same period last year, according to data released by the State Bank of Pakistan (SBP).

The persistent decline in car financing is attributed to the high cost of vehicles, which remains a substantial barrier to sales. Although some car assemblers have offered discounts on registration and other charges in recent months, the overall growth in the automotive sector remains sluggish.

In contrast, personal loans on credit cards have seen a significant increase, surging by 27.5 percent year-on-year to reach Rs. 125 billion by the end of July 2024. This rise indicates a shift in consumer borrowing preferences amid economic challenges.

Meanwhile, consumer financing for house building has also seen a decline, dropping by 3.9 percent to Rs. 203 billion by the end of July 2024. Overall, the total credit issued to end-users, encompassing various forms of consumer financing, fell to Rs. 802 billion in July 2024, marking a 5.8 percent year-on-year decrease.