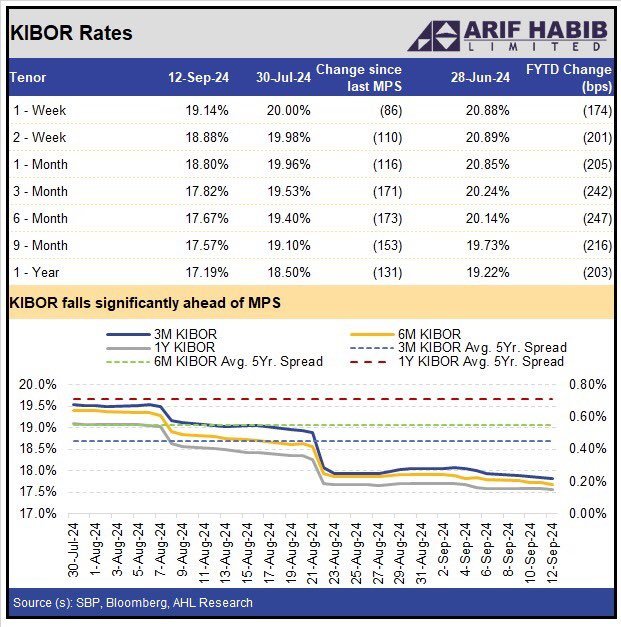

Since the last Monetary Policy Committee (MPC) meeting in July 2024, KIBOR rates have seen a significant decline, with the 3-month, 6-month, and 12-month rates dropping by 171 basis points, 173 basis points, and 131 basis points, respectively, according to a report by brokerage house Arif Habib Limited (AHL).

AHL noted that the current spread between KIBOR and the policy rate stands at -183 basis points for the 3-month rate, -193 basis points for the 6-month rate, and -231 basis points for the 12-month rate.

Historically, over the past five years, the spread has averaged +45 basis points for the 3-month rate, +55 basis points for the 6-month rate, and +71 basis points for the 12-month rate, with KIBOR typically above the policy rate.

This shift indicates that the market is anticipating not only a continuation of the rate cut cycle but also expects a substantial cut in today’s policy announcement, AHL stated. The brokerage house projects that the MPC will announce a 150 basis point cut, which would bring the policy rate down to 18 percent.