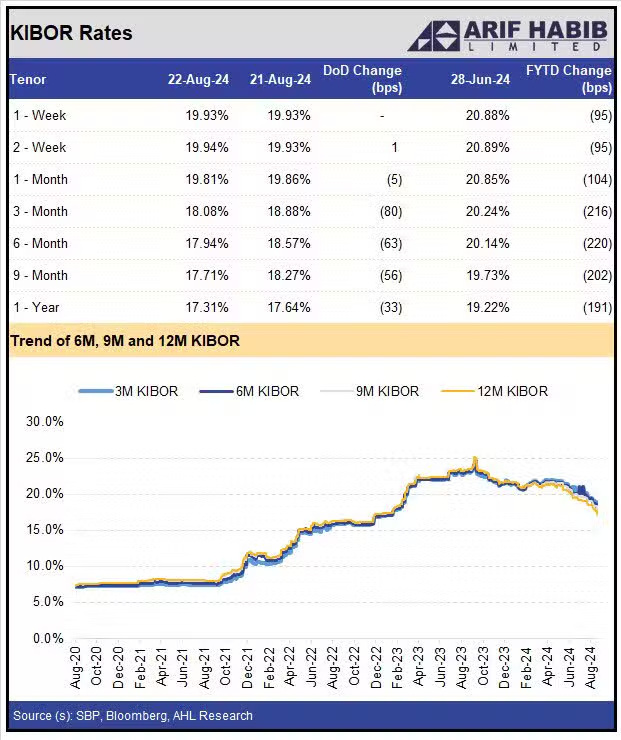

The 6-Month Karachi Inter-Bank Offered Rate (KIBOR), a key benchmark for lending rates to consumers and businesses, saw a significant drop of 63 basis points (bps) on a day-on-day basis. This decline follows a recent domestic bond auction where cut-off yields fell by up to 148 basis points.

According to data from the State Bank of Pakistan (SBP), the 6-month KIBOR now stands at 17.94 percent. Market analysts anticipate further reductions in the central bank’s policy rate in September 2024, with some brokerages predicting a 150 basis point cut, bringing the key lending rate to 18 percent.

In addition to the 6-month KIBOR, the 3-Month KIBOR decreased by 80 bps, settling at 18.08 percent, while the 1-year KIBOR dropped by 33 bps to 17.31 percent.

The bond auction on Wednesday revealed a substantial decrease in cut-off yields for Treasury Bills (T-Bills). The 3-month T-Bills saw a cut-off yield reduction of 148 bps to 17.49 percent.

Similarly, the 6-month T-Bills yield decreased by 101 bps to 17.74 percent, and the 12-month T-Bills yield fell by 74 bps to 16.99 percent.

During the competitive auction, the government successfully raised Rs. 52.01 billion for the three-month paper, Rs. 144.05 billion for the 6-month T-Bills, and Rs. 125.12 billion for the 12-month T-Bills. Additionally, Rs. 75.62 billion was raised through non-competitive bids, bringing the total amount raised to Rs. 396.8 billion.

These developments indicate a potential easing of monetary policy by the SBP, as the market anticipates further rate cuts to stimulate economic activity.