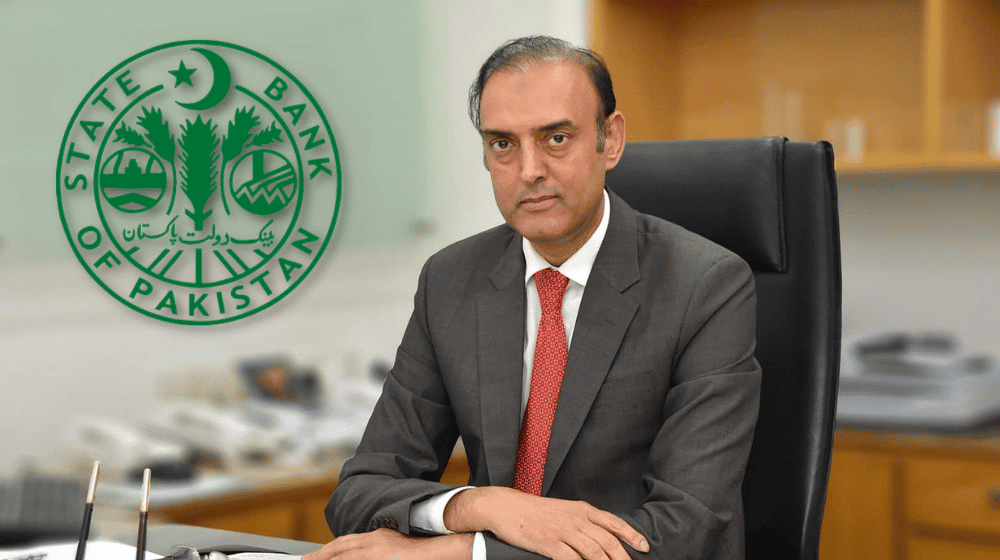

In a message delivered during the 77th Independence Day celebrations at the State Bank of Pakistan (SBP), Governor Jameel Ahmad announced a significant improvement in the country’s foreign exchange reserves, which have risen to $9.3 billion despite ongoing debt repayments.

This increase has allowed the SBP to lift import restrictions, although importers across various sectors still face challenges in opening letters of credit, reportedly due to a selective import policy aimed at reducing the trade deficit in FY24.

Governor Ahmad highlighted a substantial decrease in inflation, which fell to 11.1% in July from 28.3% in July 2023.

He also noted a dramatic reduction in the current account deficit, from $17.48 billion in FY22 to $3.2 billion in FY23, and further down to $0.68 billion in FY24. Additionally, remittances from overseas Pakistani workers have increased to $30.25 billion in FY24, up from $27.33 billion in FY23.

These improvements, according to Mr. Ahmad, are the result of strategic measures implemented by both the government and the SBP, contributing to a more favorable economic outlook. He mentioned that banks are planning to issue more loans to the agriculture and SME sectors to capitalize on their potential.

The SBP is also focusing on enhancing access to financial services through initiatives like the National Financial Inclusion Strategy, the National Financial Literacy Programme, and Banking on Equality. Governor Ahmad emphasized the importance of adopting innovative strategies to tackle ongoing economic challenges, particularly in the realm of digital innovations and cybersecurity threats.

He urged the banking industry to upgrade their systems to bolster cybersecurity and to proactively inform customers to safeguard their credentials against potential fraud.