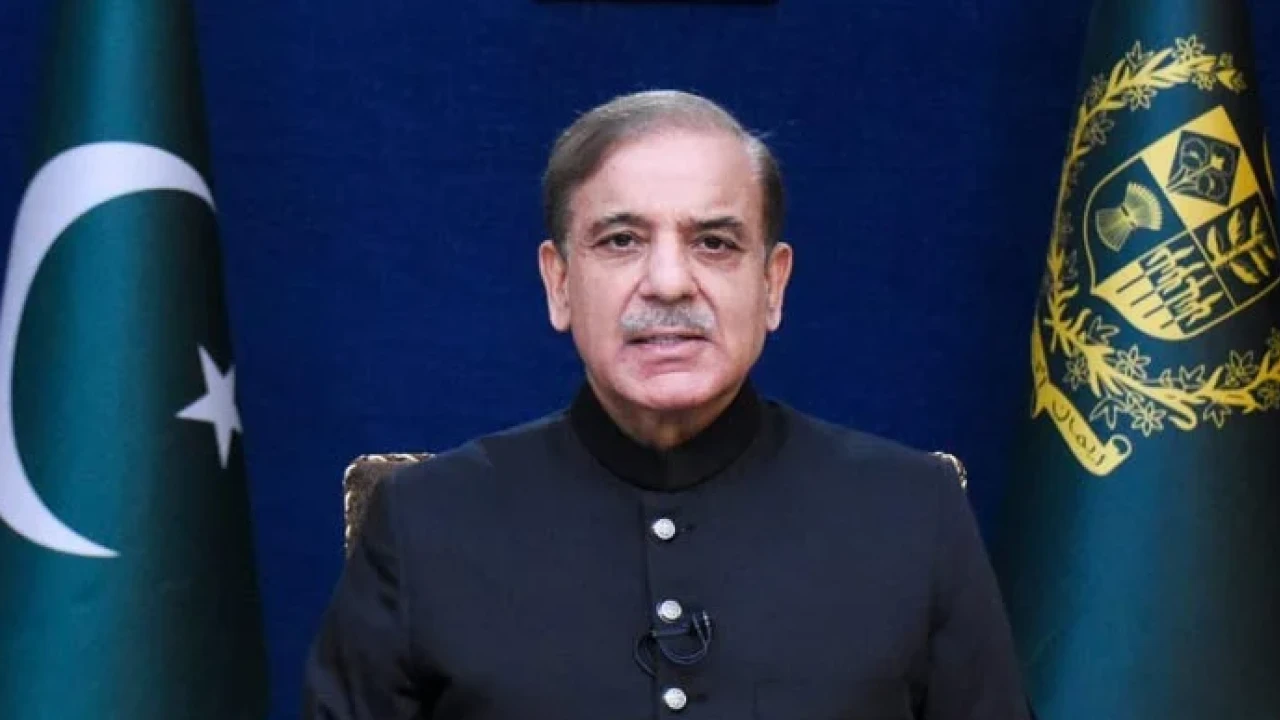

Prime Minister Shehbaz Sharif announced on Wednesday that the government has successfully persuaded the International Monetary Fund (IMF) to exempt Pakistan’s agriculture sector from taxation, despite persistent demands from the global lender.

Addressing the federal cabinet, PM Shehbaz said, “We informed the IMF that the government will not impose any tax on the agriculture sector, including fertiliser and pesticide. I am happy to convey that the IMF, despite its insistence, agreed to our terms.”

He emphasized that the agriculture sector is “already under pressure” in Pakistan, making its protection essential for the country’s economic stability.

The prime minister also shared details on income tax relief for the salaried class, stating that individuals earning between Rs. 600,000 and Rs. 1.2 million annually will pay a reduced tax rate of 1 percent, down from 5 percent in FY25. Additionally, government employees’ salaries have been increased by 10 percent.

However, this announcement contrasts with an earlier statement by Finance Minister Muhammad Aurangzeb, who, during the FY26 budget speech, indicated a 2.5 percent tax rate for the same income bracket, differing from the 1 percent mentioned in the Finance Bill 2025.

Last week, Pakistan unveiled its federal budget for 2025-26, targeting a modest economic growth of 4.2 percent, up from the projected 2.7 percent growth in FY25.

PM Shehbaz also addressed rising regional tensions, noting that the government has expanded its fiscal space to meet defence requirements amid ongoing tensions with India. “It is a dire need of the time,” he said.

The government has allocated Rs. 1 trillion under the Public Sector Development Programme (PSDP), with the prime minister stressing the importance of honoring commitments made to development partners.

He concluded by highlighting Pakistan’s success in averting a sovereign default and moving toward a sustainable economic path.