The Federal Board of Revenue (FBR) has announced new regulations to address violations by Tier-I retailers, which may result in sealing their business premises or retail stores. The FBR issued SRO.164(I)/2025 on Monday, amending the Sales Tax Rules of 2006.

According to the notification, business premises will be sealed if retailers are found to be issuing unverified invoices, if their store is disconnected from the FBR database for 48 hours, if invoices from offline periods are not entered into the system within 24 hours, or if the device fails to record invoices during offline periods. Any of these violations can lead to the sealing of the registered person’s business premises.

The FBR has also outlined the procedure for de-sealing the premises of integrated Tier-I retailers. If a business is sealed under rule 150ZF-O, the Commissioner Inland Revenue with jurisdiction over the case will impose a penalty as specified in section 33 of the Sales Tax Act. A de-sealing order will be issued within 24 hours of penalty payment and the resolution of any audit-related demands, provided that any software issues have been rectified and all requirements of Chapter XIV-AA of the Sales Tax Rules 2006 have been met.

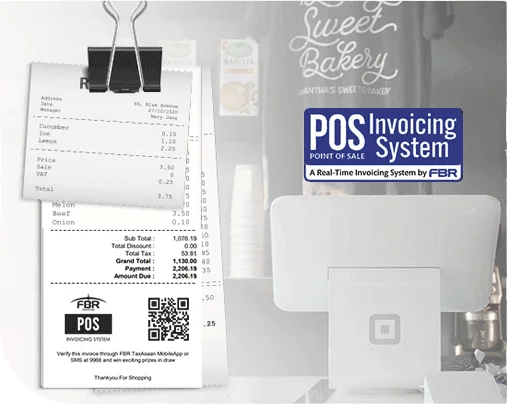

Retailers have the right to appeal against the sealing order. Following de-sealing, the Commissioner Inland Revenue will conduct a software audit of all Point of Sale (POS) machines across the retailer’s branches within three working days. This audit will help determine the extent of any under-declared sales and create a demand for any taxes that may have been evaded.

If the retailer fails to pay the assessed tax, the premises will remain sealed for a month, and if the default continues, the business will be re-sealed after 15 days. The FBR has emphasized that penalties will be imposed as per the provisions outlined in section 33 of the Sales Tax Act.