The Federal Board of Revenue (FBR) has issued new directives requiring retailers operating under the Point of Sale (POS) system to integrate digital payment facilities, including debit and credit card machines, QR codes, or other modes of digital transactions, at all sales points. The move aims to enhance transparency and streamline tax collection.

The FBR has notified these changes through S.R.O. 69(I)/2025, amending the Sales Tax Rules, 2006, to introduce a revised procedure for the electronic integration of hardware and software used by registered retailers for generating and transmitting electronic invoices.

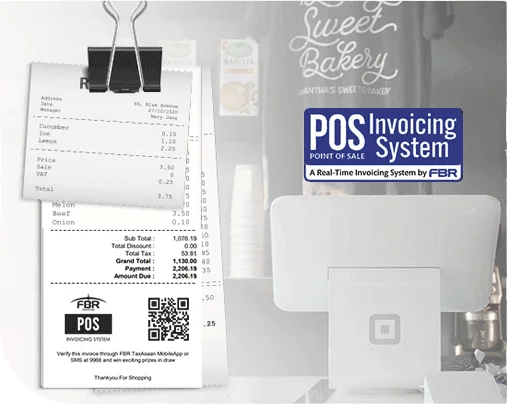

Under the amended rules, POS retailers must ensure that their electronic invoices include specific details such as:

- A unique FBR invoice number

- A verifiable QR code

- Information generated by integrated invoicing or POS software

- Retailers are also required to provide the FBR with details of their outlets, POS systems, or electronic invoicing machines through the Board’s online system. No sales will be allowed unless conducted through integrated outlets or machines capable of issuing electronic invoices.

The FBR has warned that if an integrated retailer fails to account for sales by not generating invoices with QR codes or FBR invoice numbers, the Officer of Inland Revenue will calculate and recover taxes on the unaccounted-for goods.

The updated rules also specify that POS systems or electronic invoicing machines must:

- Generate, record, and securely store invoice data

- Issue sales tax invoices in the prescribed format

- Create and record digital signatures on invoices

- Transmit invoice data to the FBR’s computerized system through secure channels

- Encrypt and preserve sales tax invoice data securely and irreversibly

- Generate and print QR codes based on unique FBR invoice numbers

The FBR’s initiative is part of its broader efforts to digitize the tax system, improve compliance, and reduce tax evasion. By mandating digital payment integration and electronic invoicing, the FBR aims to ensure greater transparency in retail transactions and enhance revenue collection.

These changes are expected to modernize the retail sector and align it with global standards, while also providing consumers with a more transparent and efficient payment experience.