Retailers in Pakistan are reportedly finding new ways to circumvent the Federal Board of Revenue’s (FBR) Point of Sale (POS) system. These retailers are allegedly manipulating the system to avoid paying taxes while charging customers higher sales values.

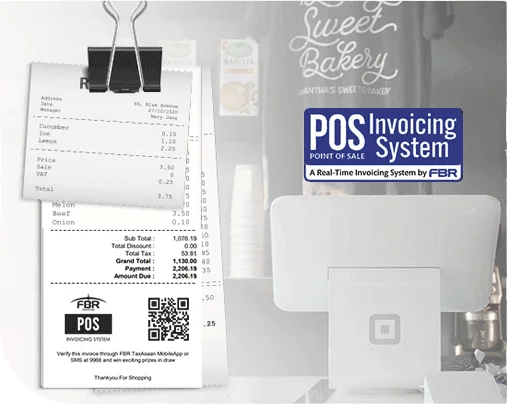

The alleged scheme involves altering the payment software used by retailers, allowing them to reprint the same QR codes and invoice numbers with inflated sale amounts. Although the original invoice is registered with the FBR for a lower amount, the receipts given to customers reflect the actual, higher sales value. This manipulation means that only a small fraction of sales are accurately reported to the POS servers.

This practice was confirmed through the Sindh Revenue Board’s eSales Reporting System (eSRB). A concerned taxpayer recently reported a coffee shop for allegedly engaging in this tax evasion tactic. After entering his purchase invoice number into the eSRB portal, he discovered that the tax amount was Rs. 70 less than what he was charged, and the sales value was lower than the receipt he received from the coffee shop.

When confronted, the shop’s manager attempted to retrieve the receipt, but the customer refused and filed an official complaint with the FBR. The coffee shop now faces potential fines of up to Rs. 1 million if found guilty of tax evasion.

The FBR is responsible for thoroughly verifying all POS invoices and taking action against those who engage in tax evasion. This incident highlights the need for stricter enforcement and monitoring to ensure compliance with tax regulations.